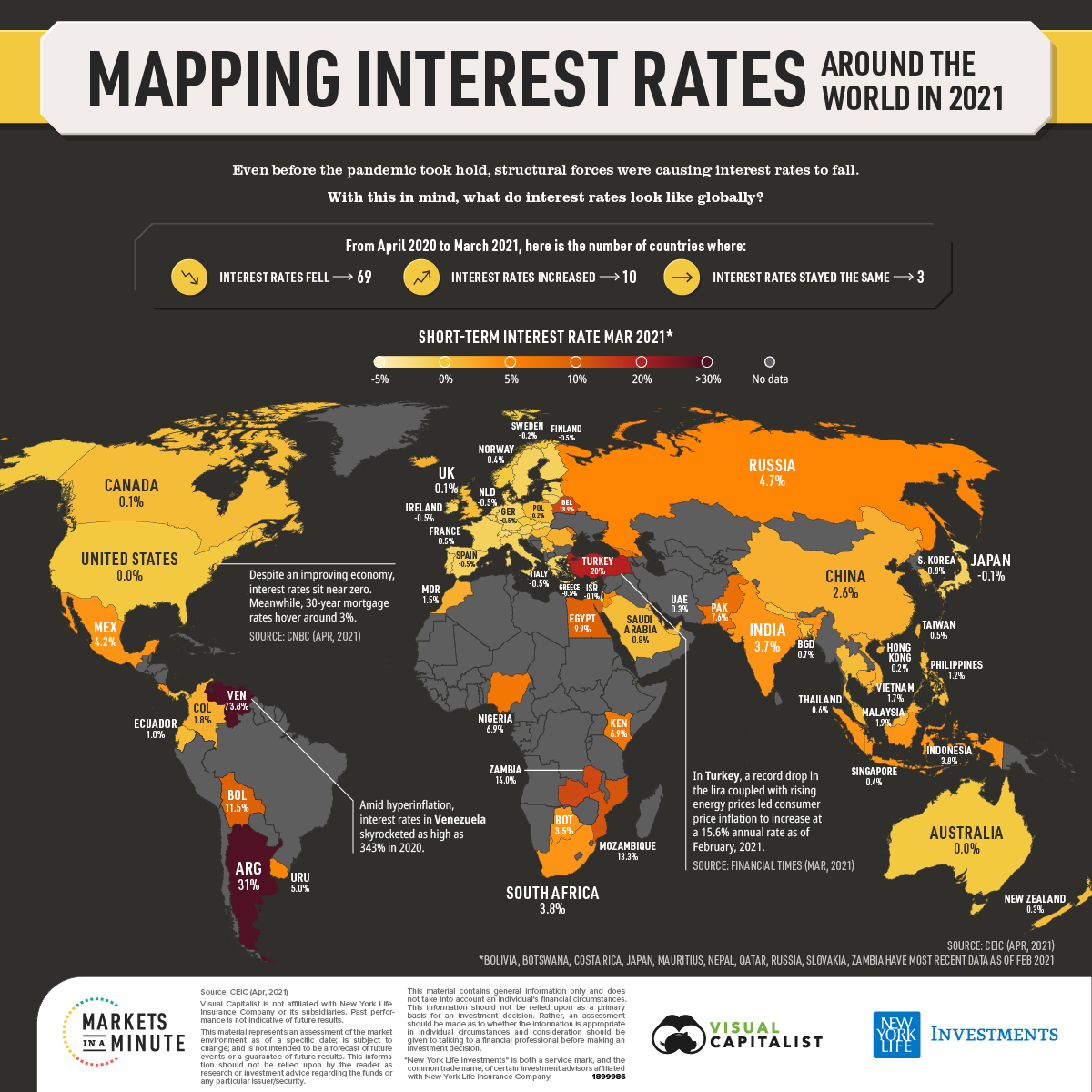

In recent years, shifts in global interest rates have significantly influenced the economic landscape. Central banks around the world, such as the Federal Reserve in the United States, the European Central Bank (ECB), and the Bank of England, have implemented various monetary policies to navigate economic challenges. This article explores how these recent interest rate changes are shaping the global economy, analyzing their impact on economic growth, inflation, financial markets, and international trade.

1. Understanding Interest Rate Changes

Interest rates, set by central banks, are crucial tools for managing economic activity. When central banks adjust these rates, they influence borrowing costs for businesses and consumers, which in turn affects economic growth and inflation. Recent trends have seen both hikes and cuts in interest rates as governments respond to shifting economic conditions.

2. Impact on Economic Growth

One of the primary ways interest rate changes affect the economy is through their impact on economic growth. Lower interest rates reduce the cost of borrowing, encouraging businesses to invest in new projects and consumers to spend more. This can stimulate economic growth as increased spending drives higher demand for goods and services.

Conversely, higher interest rates can slow down economic activity. As borrowing costs rise, businesses may postpone or cancel expansion plans, and consumers may cut back on spending. This reduction in economic activity can lead to slower growth and potentially a recession if the rates are too high or sustained for too long.

3. Influence on Inflation

Inflation is another key area impacted by interest rate changes. Lower interest rates can lead to higher inflation as increased demand for goods and services can drive prices up. Central banks often lower rates to combat deflationary pressures and boost economic activity, but if rates are too low for too long, it can lead to runaway inflation.

On the other hand, higher interest rates are used to combat inflation. By making borrowing more expensive, central banks can reduce consumer spending and business investment, thereby cooling off an overheating economy and keeping inflation in check. However, this approach can also slow economic growth and potentially lead to a downturn if not managed carefully.

4. Effects on Financial Markets

Financial markets react sensitively to changes in interest rates. When central banks raise rates, bond prices typically fall because existing bonds with lower rates become less attractive compared to new bonds issued at higher rates. Conversely, when rates are cut, bond prices generally rise.

Equity markets are also affected. Higher interest rates can increase borrowing costs for companies, which can squeeze profit margins and lead to lower stock prices. However, if higher rates signal a strong economy, it might offset negative impacts on stocks. Lower interest rates usually boost stock markets as cheaper borrowing costs can enhance corporate earnings and lead to higher stock valuations.

5. Impact on International Trade

Interest rate changes also influence international trade. Higher interest rates can attract foreign capital, leading to an appreciation of the domestic currency. While a stronger currency makes imports cheaper, it can also make exports more expensive for foreign buyers, potentially reducing demand for a country’s goods and services abroad.

Conversely, lower interest rates can weaken a currency, making exports cheaper and imports more expensive. This can boost export-driven industries but may lead to trade deficits if the value of imports rises significantly.

6. Global Economic Interconnectedness

In today’s interconnected global economy, interest rate changes in one country can have ripple effects worldwide. For instance, if the Federal Reserve raises rates, it can lead to capital outflows from emerging markets as investors seek higher returns in the U.S. This can strain the financial systems of emerging economies and affect global economic stability.

Additionally, global trade dynamics are influenced by interest rates. Changes in major economies’ interest rates can impact global supply chains, trade balances, and overall economic conditions. Countries with significant trade relationships can experience shifts in their economic fortunes based on the interest rate policies of their trading partners.

7. Future Outlook

Looking ahead, the trajectory of interest rates will likely continue to be a key determinant of global economic conditions. Central banks will need to balance their policies carefully to support economic growth while managing inflation and maintaining financial stability. As the global economy evolves, the interplay between interest rates and economic indicators will remain crucial for policymakers and investors alike.

Conclusion

Recent changes in interest rates are profoundly shaping the global economy. From influencing economic growth and inflation to impacting financial markets and international trade, these rate adjustments have wide-ranging effects. As central banks navigate these challenges, understanding the implications of their decisions is essential for businesses, investors, and policymakers to make informed decisions in an ever-changing economic landscape.