The International Monetary Fund (IMF) released its July 2024 World Economic Outlook, signaling a significant turning point for the global economy. After three years of turbulence marked by a pandemic, geopolitical tensions, and supply chain disruptions, the global economic landscape shows signs of stabilization. This report provides a comprehensive analysis of the factors contributing to this stabilization and the outlook for various regions and sectors.

Key Factors Contributing to Economic Stabilization

1. Pandemic Recovery

The COVID-19 pandemic, which severely impacted economies worldwide, has gradually receded. Widespread vaccination campaigns and improved public health measures have led to a decline in cases and deaths, allowing economies to reopen. This recovery has been crucial for sectors like tourism, hospitality, and retail, which were among the hardest hit.

2. Geopolitical Tensions Easing

Geopolitical tensions, particularly those between major economies like the United States and China, have shown signs of easing. Diplomatic efforts and trade negotiations have led to more stable international relations, reducing uncertainties in global markets. This improvement in geopolitical climate has encouraged investment and trade flows.

3. Supply Chain Improvements

Supply chain disruptions caused by the pandemic and other factors have started to resolve. Businesses have adapted by diversifying suppliers and investing in technology to enhance supply chain resilience. As a result, the flow of goods and services has become more reliable, supporting economic activities across various industries.

4. Monetary and Fiscal Policies

Governments and central banks worldwide have implemented supportive monetary and fiscal policies to mitigate the economic impact of recent crises. Low-interest rates, fiscal stimulus packages, and targeted support for businesses and individuals have helped sustain economic activity and foster recovery.

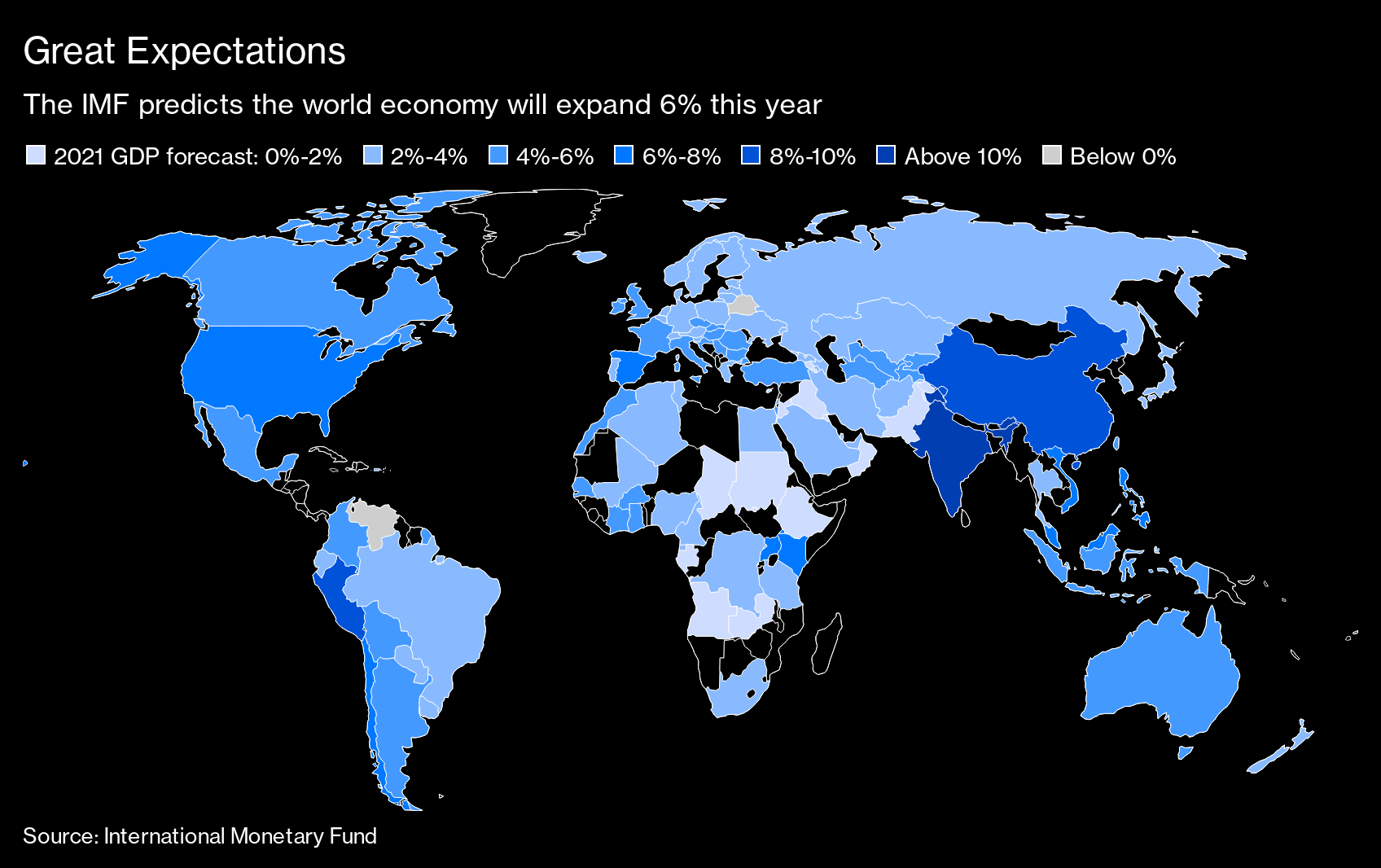

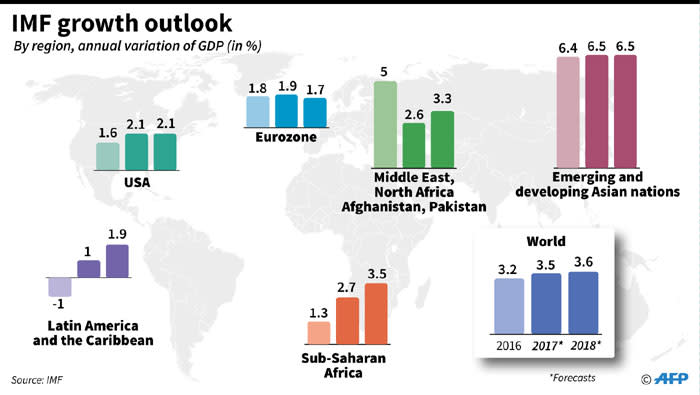

Regional Economic Outlooks

1. North America

The United States and Canada have experienced robust economic recoveries. Strong consumer spending, driven by fiscal stimulus and high employment levels, has bolstered growth. The IMF projects steady GDP growth for both countries, with an emphasis on technological innovation and infrastructure development.

2. Europe

European economies have shown resilience, particularly in the Eurozone. Despite energy price fluctuations and inflationary pressures, the region’s recovery has been supported by strong industrial production and exports. The European Central Bank’s accommodative monetary policy continues to provide a favorable environment for growth.

3. Asia-Pacific

The Asia-Pacific region remains a key driver of global economic growth. China’s economic stability, along with strong performances from India, Japan, and South Korea, has contributed to the region’s positive outlook. Trade agreements and regional cooperation initiatives are expected to further enhance economic integration and growth.

4. Latin America and the Caribbean

Latin America and the Caribbean have faced challenges, including political instability and high inflation. However, improvements in commodity prices and increased foreign investment are providing a boost to the region’s economies. The IMF emphasizes the need for structural reforms to ensure sustainable growth.

5. Middle East and North Africa (MENA)

The MENA region’s economic prospects are improving, driven by higher oil prices and efforts to diversify economies. Countries like Saudi Arabia and the UAE are investing in non-oil sectors to reduce dependency on hydrocarbons. Stability in global oil markets is crucial for the region’s continued growth.

6. Sub-Saharan Africa

Sub-Saharan Africa’s recovery is gaining momentum, supported by rising commodity prices and improved access to vaccines. However, the region still faces significant challenges, including high debt levels and poverty. The IMF calls for international support and debt relief initiatives to sustain the region’s recovery efforts.

Sector-Specific Insights

1. Technology and Innovation

The technology sector continues to be a major growth driver globally. Advances in artificial intelligence, biotechnology, and renewable energy are creating new economic opportunities. Investment in digital infrastructure and innovation ecosystems is essential for sustaining growth in this sector.

2. Healthcare

The healthcare sector is poised for growth, driven by increased demand for medical services and innovations in pharmaceuticals and biotechnology. The pandemic has underscored the importance of resilient healthcare systems, leading to higher investments in health infrastructure and research.

3. Sustainable Energy

The shift towards sustainable energy sources is accelerating. Governments and businesses are investing in renewable energy projects to reduce carbon footprints and address climate change. This transition is creating new job opportunities and driving economic growth in the green energy sector.

4. Financial Services

The financial services sector is experiencing transformation due to technological advancements and regulatory changes. Digital banking, fintech innovations, and sustainable finance initiatives are reshaping the industry. The IMF highlights the importance of regulatory frameworks that balance innovation with financial stability.

Challenges and Risks

1. Inflationary Pressures

Despite economic stabilization, inflation remains a concern in many regions. Supply chain disruptions, energy price volatility, and labor market constraints are contributing to rising prices. Central banks need to carefully manage monetary policies to control inflation without stifling growth.

2. Climate Change

Climate change poses a significant risk to long-term economic stability. Extreme weather events and environmental degradation can disrupt economic activities and impact livelihoods. The IMF emphasizes the need for global cooperation on climate action and investments in climate resilience.

3. Debt Levels

High debt levels in both developed and developing economies are a potential risk. Managing debt sustainability while supporting economic recovery is a delicate balance. The IMF advocates for prudent fiscal policies and international cooperation on debt relief initiatives.

4. Inequality

Economic inequalities, exacerbated by the pandemic, remain a critical issue. Ensuring inclusive growth that benefits all segments of society is essential for long-term stability. Policies that promote education, healthcare access, and social safety nets are crucial in addressing inequality.

Conclusion

The IMF’s July 2024 World Economic Outlook provides a cautiously optimistic view of the global economy. After three challenging years, signs of stabilization are emerging across various regions and sectors. However, addressing inflationary pressures, climate change, debt levels, and inequality will be essential for sustaining this recovery. With coordinated efforts from governments, businesses, and international organizations, the global economy can navigate these challenges and achieve sustainable growth.