In the intricate web of global finance, currency shifts are a significant factor influencing economic stability and growth. Central banks, as the primary monetary authorities, play a pivotal role in shaping these shifts through their policies. This article delves into how central bank policies impact major economies, driving changes in currency values and affecting global economic dynamics.

Understanding Central Bank Policies

Central banks manage monetary policy to achieve economic objectives such as controlling inflation, managing employment levels, and ensuring financial stability. The primary tools at their disposal include:

- Interest Rates: By raising or lowering interest rates, central banks influence borrowing and lending activities. Higher interest rates typically strengthen a currency as they attract foreign investment, while lower rates can weaken it.

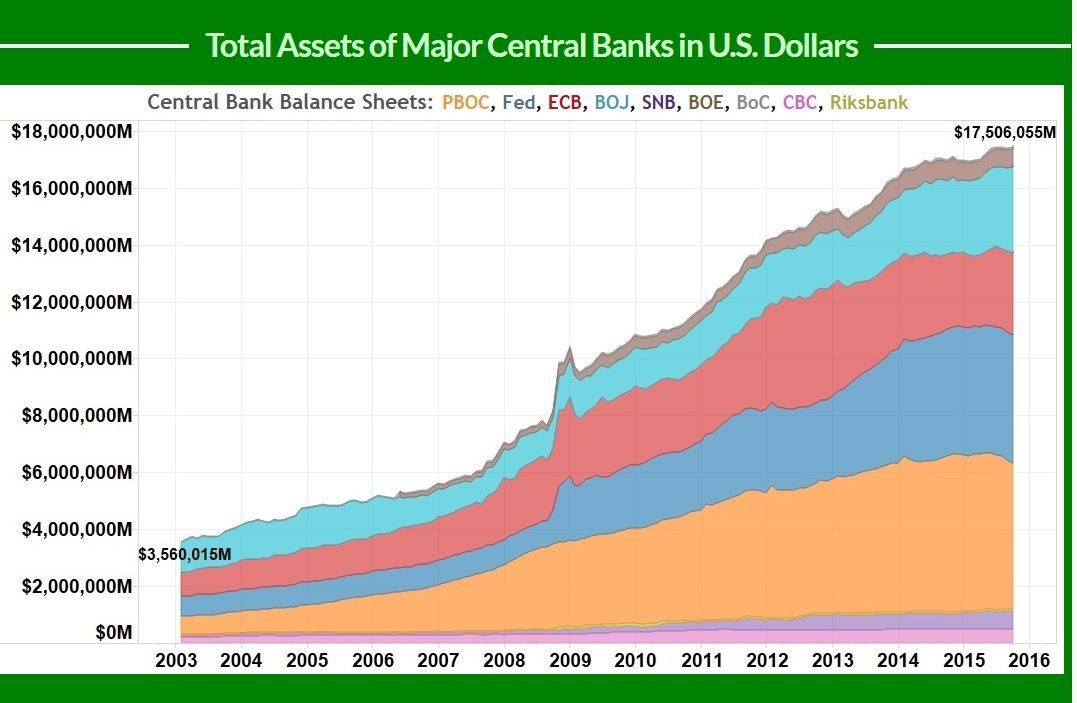

- Quantitative Easing (QE): QE involves central banks purchasing government securities or other financial assets to inject liquidity into the economy. This policy can lower interest rates and increase money supply, often leading to currency depreciation.

- Foreign Exchange Interventions: Central banks can directly intervene in the foreign exchange market to stabilize or influence their currency’s value by buying or selling foreign currency.

- Forward Guidance: This involves communicating future policy intentions to shape market expectations and influence economic behavior.

Impact on Major Economies

The United States

The Federal Reserve (Fed), the central bank of the United States, holds significant sway over global currency markets. The Fed’s policies, particularly interest rate changes and QE, have far-reaching implications.

- Interest Rate Hikes: When the Fed increases interest rates, it often leads to an appreciation of the US dollar. This is because higher interest rates offer better returns on investments denominated in USD, attracting foreign capital.

- Quantitative Easing: Conversely, QE policies tend to weaken the dollar. By increasing the money supply, the Fed can spur economic activity, but this can also lead to a decrease in the currency’s value.

The Eurozone

The European Central Bank (ECB) manages monetary policy for the Eurozone, and its actions significantly impact the euro’s value.

- Negative Interest Rates: The ECB has employed negative interest rates to stimulate the economy. This policy can lead to a weaker euro as it discourages investment in euro-denominated assets.

- Asset Purchase Programs: Similar to the Fed’s QE, the ECB’s asset purchase programs aim to inject liquidity into the economy, often resulting in a depreciated euro.

Japan

The Bank of Japan (BoJ) has long battled deflation and stagnant growth, employing aggressive monetary policies.

- Quantitative and Qualitative Easing (QQE): The BoJ’s QQE involves large-scale asset purchases and targeting the yield curve to maintain low interest rates. These measures typically weaken the yen.

- Negative Interest Rates: Like the ECB, the BoJ has also implemented negative interest rates, which can lead to a depreciation of the yen as investors seek higher returns elsewhere.

China

The People’s Bank of China (PBoC) manages the renminbi (RMB) within a managed float system, meaning it influences the currency’s value through various mechanisms.

- Currency Pegging: The PBoC often pegs the RMB to a basket of currencies, including the US dollar. This practice can stabilize the RMB but also subjects it to fluctuations in the value of the pegged currencies.

- Foreign Exchange Reserves: The PBoC holds substantial foreign exchange reserves, which it can use to intervene in currency markets and influence the RMB’s value.

Global Economic Implications

The policies of major central banks not only affect their respective economies but also have broader global implications.

Trade Balances

Currency shifts can significantly impact trade balances. A stronger currency makes exports more expensive and imports cheaper, potentially leading to trade deficits. Conversely, a weaker currency can boost exports and reduce imports, improving the trade balance.

Investment Flows

Changes in currency values influence global investment flows. Higher interest rates in one country can attract foreign investment, strengthening the currency. Conversely, lower rates may lead to capital outflows as investors seek better returns elsewhere.

Inflation and Deflation

Central bank policies aimed at controlling inflation or deflation can have international repercussions. For instance, if a major economy like the US experiences high inflation and raises interest rates, it can lead to global currency appreciation and potentially export inflation to other economies.

Financial Market Volatility

Sudden shifts in central bank policies can lead to financial market volatility. Investors may react to unexpected policy changes by rapidly reallocating assets, causing fluctuations in currency values and stock markets.

Conclusion

Central bank policies are a fundamental driver of currency shifts, impacting major economies and the global financial system. Understanding these policies and their implications is crucial for navigating the complexities of international finance. As central banks continue to adapt to evolving economic conditions, their actions will remain a key factor in shaping global currency dynamics and economic stability.